Online bills are available 24 hours a day, seven days a week. An email will be sent to the student's Quinnipiac email account when charges are applied for the upcoming semester, based on the timeframes below.

-

Summer Semester - Typically the second week in May

-

Fall Semester - Typically mid to late June

-

Spring Semester - Typically the first week of December

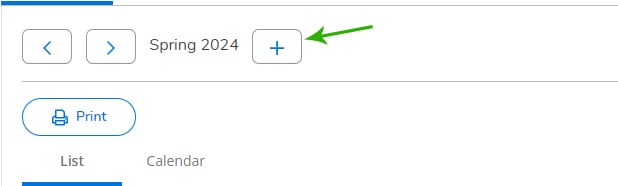

J-Term and Spring 2024

Students enrolled in the January and Spring 2024 terms can expect their invoices to become available and tuition to be due according to the following chart. Students will be emailed when invoices are available.

January 2024

| Term | Term Dates | Invoices Available Approximately* | Payment Due Date | Payment Plan Installment Dates | Add/Drop Date |

|---|---|---|---|---|---|

| January 2024 - 24/JA |

1/2-1/19/24 | 11/28/23 | 12/15/23 | There are no payment plans for January courses. | 1/3/24 |

Undergraduate and Graduate Spring 2024

These dates are not for School of Law or School of Medicine. See below for those details.

| Term | Term Dates | Invoices Available Approximately* | Payment Due Date | Payment Plan Installment Dates | Add/Drop |

|---|---|---|---|---|---|

|

Spring 2024 - 24/SP |

1/22-5/11/24 | 11/28/23 | 12/15/23 | 12/15/23, 1/15/24, 2/15/24, 3/15/24, 4/15/24 |

15-week courses: 1/26/24 First 7-week courses: 1/23/24 |

School of Law Spring 2024

| Term | Term Dates | Invoices Available Approximately* | Payment Due Date | Payment Plan Installment Dates | Add/Drop |

|---|---|---|---|---|---|

| Law - 24/LS | 1/8-5/10/24 1Ls 1/10-5/10/24 |

11/28/23 | 12/15/23 | 12/15/23, 1/15/24, 2/15/24, 3/15/24, 4/15/24 |

1/12/24 |

School of Medicine Term 2 2024

| Term | Term Dates | Invoices Available Approximately* | Payment Due Date | Payment Plan Installment Dates | Loan Disbursement |

|---|---|---|---|---|---|

| Med Year 1 Term 2 - 24/MS1 Class of 2027 |

1/2-5/24/24 | 11/28/23 | 12/15/23 | 12/15/23, 1/15/24, 2/15/24, 3/15/24, 4/15/24 |

1/2/24 |

| Med Year 2 Term 2 - 24/MS2 Class of 2026 |

12/4/23-3/29/24 | 11/28/23 | 12/15/23 | 12/15/23, 1/15/24, 2/15/24, 3/15/24, 4/15/24 |

12/4/23 |

| Med Year 3 Term 2 - 24/MS3 Class of 2025 |

11/6/23-4/19/24 | 10/23/23 | 11/15/23 | 11/15/23, 12/15/23, 1/15/24, 2/15/24, 3/15/24 |

11/6/23 |

| Med Year 4 Term 2 - 24/MS4 Class of 2024 |

11/20/23-5/3/24 | 10/23/23 | 11/15/23 | 11/15/23, 12/15/24, 1/15/24, 2/15/24, 3/15/24 |

11/20/23 |

* Approximate date. Students will be emailed when invoices are available.

Summer and Fall 2024

Students enrolled in the January and Spring 2024 terms can expect their invoices to become available and tuition to be due according to the following chart. Students will be emailed when invoices are available.

Summer 2024

| Term | Term Dates | Invoices Available Approximately* | Payment Due Date | Payment Plan Installment Dates | Add/Drop Date |

|---|---|---|---|---|---|

| Summer 2024 |

Law: 5/13-7/3/24 Session 1 (5-week courses): 5/20-6/21/24 Session 1 (7-week courses): 5/20-7/5/24 Session 1 (12-week courses): 5/20-8/9/24 Session 2 (5-week courses): 7/8-8/9/24 Session 2 (7-week courses): 7/8-8/23/24 |

4/24/24 | 5/15/24 | There are no payment plans for summer courses. | Session 1: 5/21/24 Session 2: 7/9/24 |

Fall 2024

These dates are not for School of Law or School of Medicine. See below for those details.

| Term | Term Dates | Invoices Available Approximately* | Payment Due Date | Payment Plan Installment Dates | Last Day to Add/Drop Course |

|---|---|---|---|---|---|

|

First-Year Students |

8/26-12/14/24 | 6/14/24 | 7/12/24 | 7/12/24, 8/12/24, 9/12/24, 10/12/24, 11/12/24 |

15-week courses: 8/30/24 First 7-week courses: 8/27/24 |

School of Law Fall 2024

| Term | Term Dates | Invoices Available Approximately* | Payment Due Date | Payment Plan Installment Dates | Add/Drop |

|---|---|---|---|---|---|

| Law - 24/LF | 8/19-12/18/24 | 7/1/24 | 7/31/24 | 7/31/24, 8/31/24, 9/30/24, 10/31/24, 11/30/24 |

8/27/24 |

School of Medicine Term 1 2024

| Term | Term Dates | Invoices Available Approximately* | Payment Due Date | Payment Plan Installment Dates | Loan Disbursement Date |

|---|---|---|---|---|---|

| Med Year 1 Term 1 - 24/MF1 | 8/5-12/20/24 | 6/14/24 | 7/12/24 | 7/12/24, 8/12/24, 9/12/24, 10/12/24, 11/12/24 |

8/5/24 |

| Med Year 2 Term 1 - 24/MF2 | 8/12-12/6/24 | 6/14/24 | 7/12/24 | 7/12/24, 8/12/24, 9/12/24, 10/12/24, 11/12/24 |

8/12/24 |

| Med Year 3 Term 1 - 24/MF3 | 4/15-11/1/24 | 4/16/24 | 5/15/24 | 5/15/24, 6/15/24, 7/15/24, 8/15/24, 9/15/24 |

4/15/24 |

| Med Year 4 Term 1 - 24/MF4 | 4/22-11/8/24 | 4/16/24 | 5/15/24 | 5/15/24, 6/15/24, 7/15/24, 8/15/24, 9/15/24 |

4/22/24 |

* Approximate date. Students will be emailed when invoices are available.

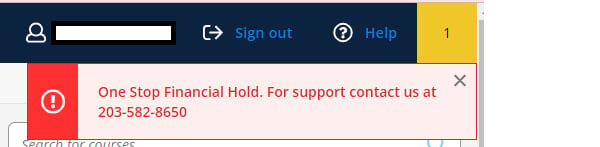

Generally, yes, the full balance must be paid by the due date for the account to remain in good standing, or satisfactory financial arrangements must be made by the due date.

Financial arrangements may include:

-

Enrolling in a university-sponsored payment plan and paying any balance due, where applicable.

-

Paying the balance due after estimated financial aid is applied.