The Student-Managed Portfolio is a portion of the Quinnipiac University Endowment Fund. Each semester, undergraduate finance students in the Applied Portfolio Management course (FIN 450) work with Professor of Finance, Finance chair and portfolio founder Matthew O’Connor and Professor Ted Koly, ‘06, MBA ’08 to curate growth of the portfolio. Students manage real funds and assume roles which mirror those that launch careers in the financial sector. They are responsible for developing investment strategies, constructing, monitoring and rebalancing the portfolio and reporting on actual portfolio performance.

On December 10, the portfolio’s fall 2025 analysis and outlook was presented to Quinnipiac President Marie Hardin, School of Business Dean Holly Raider, university trustees, members of the School of Business Advisory Board, faculty, alumni, parents, colleagues and students in the School of Business auditorium as well as additional audience members attending via Zoom.

O’Connor said he saw a very meaningful juxtaposition between the work of the students this semester and presenting the portfolio’s performance in Quinnipiac’s brand-new School of Business for the first time.

“This school, as well as all the other projects on campus, really demonstrates the university’s confidence in our education for our students and in the confidence in the future,” O’Connor said. “I think that mirrors a lot of what our students have done this year. You’ll see, through their presentation, that they have acted with a lot of confidence and conviction around what they’ve done.”

Students begin their experience as equity analysts on a sector team, responsible for monitoring the companies in their sector, performing comprehensive financial analyses and presenting recommendations to increase or decrease existing investments. Equity analysts are also expected to research, identify and pitch new investment opportunities for either the growth or value funds. A two-thirds vote of the class is required for any actions taken.

Successful equity analysts have the opportunity to be promoted to fund managers. Fund managers within the Student Managed Portfolio make final allocation recommendations for both funds, oversee the completion of cumulative performance reports and present a comprehensive global macro outlook to inform future investment decisions and asset allocation choices.

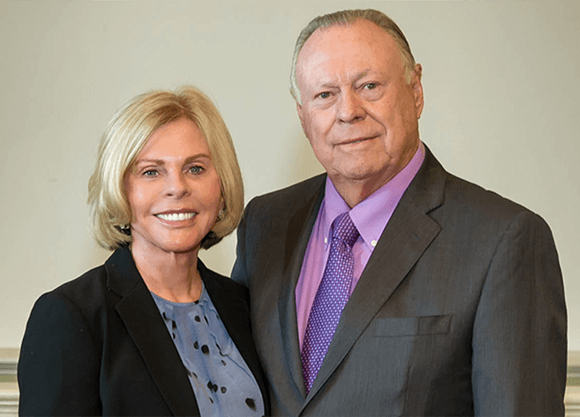

O’Connor invited Trustee Emeritus M.S. Koly (father of Ted Koly) to discuss the history of the portfolio. Koly expressed his appreciation for O’Connor’s vision.

“We wouldn’t be here today if it wasn’t for Professor Matt O’Connor,” said Koly.

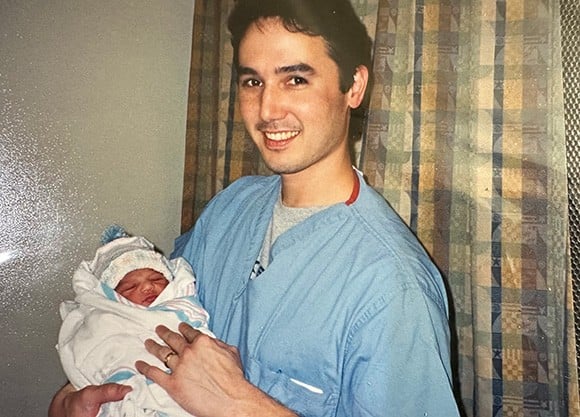

While serving as Dean of the School of Business, O’Connor led a successful effort to raise $25,000 annually in 2002 and 2003, seeding the portfolio with $50,000. In 2010, with a donation of $5,000, the growth fund was created and rose to $80,000 within six months.

While serving as a trustee and chairman of the Quinnipiac University Endowment Fund, Koly petitioned the committee, university leadership, and the full Board of Trustees to channel additional money into the portfolio. In 2014, the Board of Trustees supported transferring $360,000 from the endowment fund to add to the Student-Managed Portfolio.

“I’ve been absolutely impressed with the way the student-managed fund has run the business, and how Matt and Ted have managed it and the rules you have established,” Koly said.

Fall 2025 fund managers John Cichonski, ’25, MBA ’26, Collin Wilcox ’26, and Rocco Palladino ’26, MBA ’27 gave an overview of the portfolio, its growth through the years, and the strategies employed this semester.

“Since 2014, all the growth in the portfolio has been strictly returns and dividends. We’re really proud of that metric, and we’re happy to report that we’re able to cross that $6 million mark,” said Wilcox.

Cichonski also reflected on the history of the portfolio and the exceptional growth realized this semester.

“We began with a $25,000 allocation in 2002, and from there we are currently above $6.1 million. These increases are all from investment returns, dividends, additional allocations from the endowment and of course generous donations,” Cichonksi said. “We were at about $4.8 million going into May so we are up $1.3 million, which is a huge accomplishment for us as managers and all the analysts here.”

As of November 30, 2025 the value fund was at $5.3 million and the growth fund was at $775,000.

As benchmarks, the value fund is most mirrored by the S&P 500 and the growth fund is most comparable to the iShares Russell 1000 Growth. Between December 2024 and November 30, 2025, the portfolio’s value fund returned 21.64%, besting the S&P 500 which returned approximately 16.50% during the same period. The growth portfolio also performed extremely well, returning 40.67% between December 2024 and November 30, 2025 against the Russell’s return of 19% for the same period.

Student-Managed Portfolio sectors include holdings in communications, consumer discretionary, healthcare, consumer staples, energy, materials, utilities, financial, real estate and industrials. Student analysts are given three to six companies to manage within their sector. By conducting in-depth research and evaluating existing holdings, they pitch prospective companies using a Discounted Cash Flow (DCF) model valuation to estimate the value of an investment based on expected future cash flows.

Taking current conditions into consideration, Cichonski, Wilcox and Palladino developed an in-depth 2025-2026 macroeconomic outlook which seeks to capture long-term secular opportunity while managing near-term volatility. They determined growth-oriented allocations should emphasize innovation-driven companies with durable competitive advantages and improving paths to profitability, while value-oriented positioning should focus on firms with strong balance sheets, consistent cash flows, and pricing power capable of navigating late-cycle conditions.

On December 10, smartly-dressed analysts and their managers presented sector outlooks. Dropping huge names of portfolio stocks ranging from Amazon.com, Google and Meta to Apple, Microsoft, IBM, Telsa, Exxon, WalMart, Johnson & Johnson, Eli Lilly and many more, they discussed existing holdings while also introducing results from rising companies added this semester.

In his post shared at LinkedIn, Cichonski reflected on the opportunities presented by the course, its instructors and supporters.

“This course has been one of the most rewarding experiences during my time at Quinnipiac. Being able to put real capital behind our ideas, debate them with a room full of sharp, motivated students, and learn from seasoned faculty made this class feel like a true investment firm environment,” Cichonski said.

In this Article

Stay in the Loop

Quinnipiac Today is your source for what's happening throughout #BobcatNation. Sign up for our weekly email newsletter to be among the first to know about news, events and members of our Bobcat family who are making a positive difference in our world.

Sign Up Now