The taxpayers who will reap the most rewards from this program are those who have previously filed online with commercial software systems such as TurboTax, TaxSlayer and more. However, with Direct File, taxpayers can prepare their own taxes and then file online directly with the IRS, eliminating the need for commercial taxpaying sites. This IRS system will not be available to every single taxpayer, but to those who have relatively simple tax returns.

“While the concept of Direct File does sound promising, an area of concern relates to customer service and support,” said Maron. “The IRS has indicated that they will have customer service representatives dedicated to servicing taxpayers utilizing Direct File. However, in the past, the IRS has had its share of complaints about customer service, backlogs of unresolved questions, long hold times, etc. So, this begs the question, will the customer service from the IRS to Direct File users be any better or remain inherently flawed? My guess would be the latter.”

In 2024, only 13 states will have access to Direct File including Alaska, Arizona, California, Florida, Massachusetts, Nevada, New Hampshire, New York, South Dakota, Tennessee, Texas, Washington, and Wyoming.

While Maron expressed that this cutting-edge technology will likely be successful, he believes that it will not reach the federal government’s high expectations for change in taxpaying.

“No matter how easy the government makes it to e-file your own tax return, it does not address the fact that taxes are hard to understand, and most taxpayers will continue to utilize paid tax preparers,” Maron said.

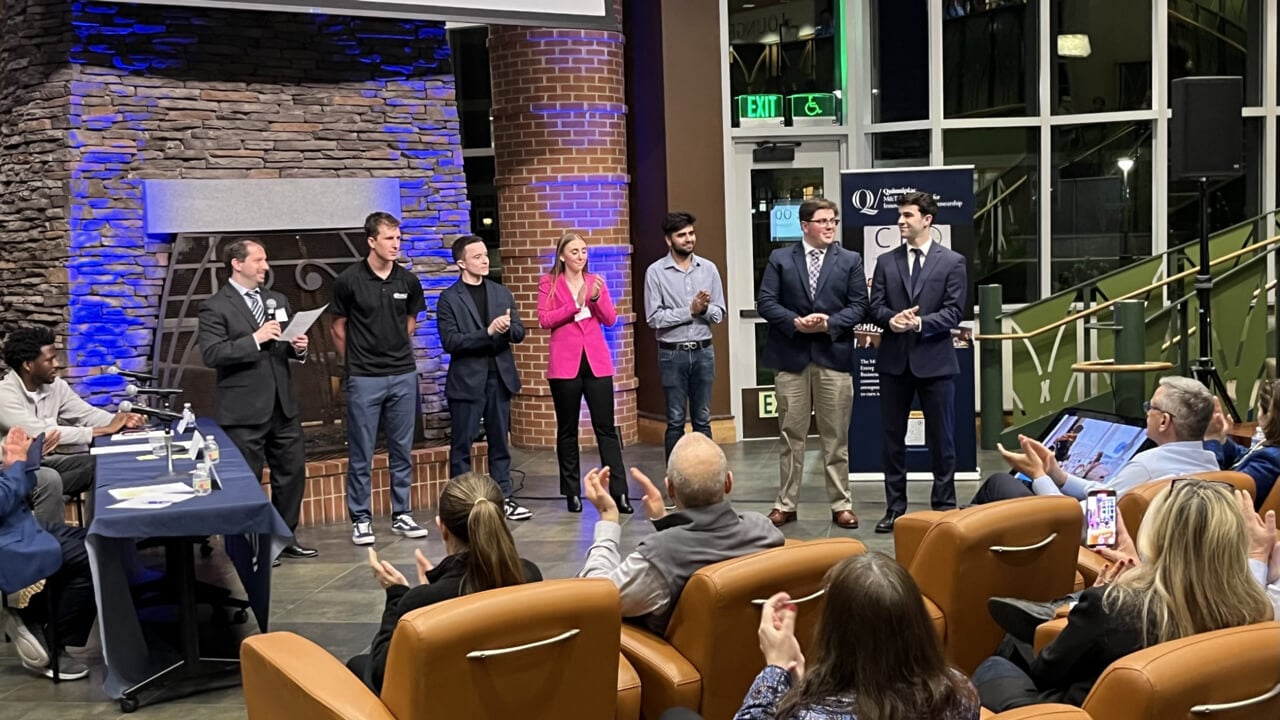

In addition to the IRS services, Quinnipiac offers a tax preparation service to assist the community with finances. The 2024 Quinnipiac VITA (Volunteer Income Tax Assistance) preparation service will be held at the ML Keefe Community Center in Hamden every Thursday from 3 to 8 p.m. starting February 15 and running through April 11, with the help of professionals.

In this Article

Stay in the Loop

Quinnipiac Today is your source for what's happening throughout #BobcatNation. Sign up for our weekly email newsletter to be among the first to know about news, events and members of our Bobcat family who are making a positive difference in our world.

Sign Up Now